“There is no such thing as a fixed return in the stock market”

The Ritz Consultancy Service founder CA Amber Dalal has been arrested by Mumbai Police from Uttrakhand. Amber used to run a service claiming “FIXED MONTHLY RETURNS” in Mumbai, owning almost ₹380+ crs of Investors.

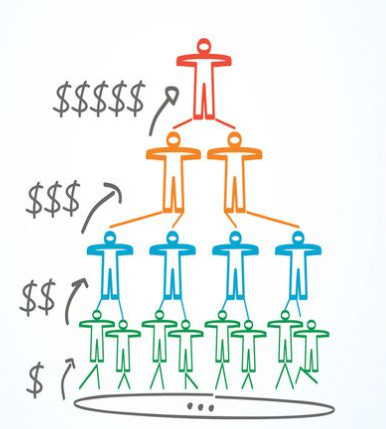

Dalal has been running this scheme for a decade now, this scheme involved a minimum investment of ₹10 lakhs and instead issued a stamp paper of ₹500 as a guarantee. Claimed a risk-free return, but the document also mentioned involvement in the futures and options(FnO), which is not at all risk-free. In the early years, word-of-mouth spread, and Ritz had huge investments. Few Investors claim that they used to receive 1.6%-2% return every 10th day of the month, totaling 22%-24% a year. Amber didn’t only attract investment from India but also accounted for half a million dollars from the UK, US, China Dubai, and Australia.

What Went Wrong?

Some investors of Ritz were totally dependent on monthly returns, as it was only their source of income, they practically invested their fortune into it. As earlier mentioned Amber used to invest in FnO which was a highly risky asset, but he wasn’t registered to any MCX or Commodity account, which makes it clear he used his personal account for all the transactions.

As monthly payouts were required, the investment cycle was for less than a month. The signs of trouble were there from almost a year. When one investors payouts were getting delayed, they requested for there whole principle and Dalal acted in a rude way. After few months effort investor got back his entire amount. But others investors weren’t this lucky.

This brings out 2 scenarios, either dalal was involved in lending schemes to higher a payout every month or Dalal was invioved in stock manipulation through his protiertry, that account he used to operate peeny stocks and was charged ₹2 lakhs as fine by SEBI.

EOW has froze 33 bank accounts and some balance are just few thousands . Hopefully, this will revial a trail that tracks back to the money.

These scams have become a common scenario these days. Investors chase for higher returns. Regardless of considering the risk. A investor should always be aware where is he investing even if the amount is ₹10.